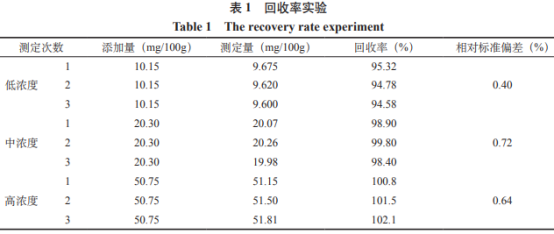

选用空白试剂加标的气相确定方法来验证回收率,分别添加低、色谱酸中、测定高3个浓度,鲜马按照上述方法测定后计算加标回收率及相对标准偏差,奶中结果如表1。脂肪

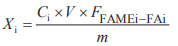

评定某个项目的不确定度时,应在计算公式的气相确定基础上建立数学模型并逐步分析可能引入不确定度的因素。本实验以外标法峰面积定量,色谱酸试样中脂肪酸的测定含量按下式计算:

式中:

Xi—试样中各脂肪酸的含量,单位为毫克每百克(mg/100g);Ci—试样测定液中各脂肪酸甲酯的鲜马含量(μg/mL);

从测量方法、数学模型及实际实验操作可知,奶中鲜马奶中脂肪酸测量的脂肪不确定度来源主要包括:称取样品误差m、移取试剂体积误差V、度评定标准物质纯度误差P、气相确定方法重复性误差rep、方法回收率误差R等。鱼骨图分析如下:

结合数学模型和《化学分析中不确定度的评估指南》,气相色谱法测定鲜马奶中棕榈酸含量的相对标准不确定度的计算公式为:

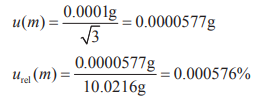

样品采用万分之一天平进行称量,称样量为10.0216g(精确至0.0001g),根据该天平鉴定证书可知其最大允差为±0.0001g,按照均匀分布,采用B类方法评定,则样品称量过程中天平引入的标准不确定度和相对不确定度为:

在样品的前处理过程中,涉及以下几个移取试剂的步骤可能引入不确定度,需分别进行计算:①采用10~100.0μL量程的移液器加入0.05mL的盐酸水溶液;②采用0~10.00mL量程的移液管加入10mL的正己烷;③采用0~10.00mL量程的移液管吸取上清液2.0mL;④采用100~1000μL量程的移液器加入0.8mL的氢氧化钾―甲醇溶液。以下分别计算四个步骤的标准不确定度和相对不确定度。

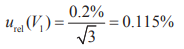

①根据10~100.0μL量程的移液器检定报告,移取50.0μL液体的误差为±0.2%,则相对不确定度为:

②依据“JJG196-2006常用玻璃量具检定规程”,0~10.00mL量程的A级分度移液管的最大允差为±0.05mL。实验室温度波动在20±5℃时,正己烷的膨胀系数(参照汽油)为0.95×10-3/℃。按照均匀分布,吸取10.0mL正己烷的吸量管的标准不确定度和温度引起的体积标准不确定度为:

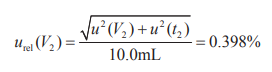

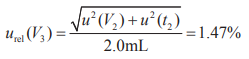

则步骤②的相对不确定度为:

③由于采用的分度吸量管规格与②中相同,且吸取的2.0mL上清液主要为正己烷,故计算移液管的不确定度和由温度引起的体积标准不确定度参照②中的算法进行:

则步骤③的相对不确定度为:

声明:本文所用图片、文字来源《中国食品添加剂》,版权归原作者所有。如涉及作品内容、版权等问题,请与本网联系

相关链接:脂肪酸,正己烷,氢氧化钾,棕榈酸

友情链接: 请收藏!2023广州纺博会新最全观展攻略十大放心米粉婴儿品牌推荐充值不限额度 实名认证虚设 江苏省消保委调查未成年人游戏充值、直播打赏四川开展“你点我检”食品安全在身边活动Levi's? 把自然穿在身上 让假期长出翅膀小孩老吐奶怎么回事常见原因和解决方法穿上宝儿宝童装新品 奔赴山野间的清晰烂漫加替沙星对映异构体拆分研究为电商人赋能的盛会2023第六届上海网红品牌博览会官宣2022 TCE服装展开启全民探索服装定制新世界自酿葡萄酒在酿造期间甲醇含量控制研究(一)磨砂玻璃脏了怎样清洗,磨砂玻璃怎么清洗不花?,经验交流山东严查转供电违法行为 立案调查3家企业高效液相色谱法(十一)凌霄花化学及临床应用研究进展(一)怎样去除玻璃表面的胶痕 玻璃胶除胶剂的注意事项,行业资讯如何分辨玻璃是否已钢化 钢化玻璃相比有哪些优点,行业资讯化学发光法测定硫酸特布他林的含量山东药品执法办案今年重点抓好五大方面工作激光电视欲与液晶电视在75英寸激战 壮大还需差异化应用场景,行业资讯锗元素溶液标准物质:专业测定锗元素含量必备瑞达货物:下游订单有所增加,玻璃震荡上涨,市场研究新一轮“停工令”来袭,涉及28个城市!,行业资讯纽发姆推出新型除草剂Scorch EXT:含有效成分Duplosan食品包装纸中11种DSD肉制品质量安全三年提升行动在邯郸市市场监管局召开手术医师无在华行医资格 美容门诊部被判三倍赔偿深圳消委会发函美团、饿了么 调查佣金比例设置福建省开展知识产权宣传周活动彩绘玻璃的太空般办公空间丨Mindvalley总部,行业资讯手机操作轻松完成 福建全面推行个体工商户全程智能化登记石英玻璃主要成分与特点 石英玻璃可以耐酸腐蚀吗,行业资讯新征程新面貌 2023中国玩协四展回归上海!自酿葡萄酒在酿造期间甲醇含量控制研究(三)CCE北京国际服装定制展 所罗 为定制而生大牌欧莱雅、强生,在中国找到了营销法宝!天津市市场监管委着力推进帮扶结对困难村广东市场监管局多举措推儿童口罩团体标准落地见效长沙千亿显示功能器件产业指日可待,企业新闻航空玻璃是哪种特殊玻璃 防弹玻璃结构有什么特点,行业资讯第30届FASHION SOURCE时尚之源深圳展、AW25深圳原创时装周韩2020年速冻饺子出口额创新高,破5000万美元湖北启动“计量服务中小企业行”活动 为千家中小企业精准施“测”连续18年获迪士尼授权 古部携众多新品亮相深圳玩具展挣脱束缚,回溯潮流青年的风格本我16省市8月户用光伏新增装机402.10MW,行业资讯月子宝宝正确睡姿图(如何让宝宝睡得更舒适)重庆北碚:筹集30万只口罩助力复工复产2023中国西部国际女性品牌内衣展览会叮当猫2025夏季新品来袭!让孩子秒变潮流小明星!江苏南京:开学首日检查学生就餐安全萌娃穿搭这样选 出游快乐与出片率双倍拉满!AGC:中国新厂将生产大型3D/复杂形状的汽车显示器保护玻璃,企业新闻金刚玻璃股东拉萨金刚抵押展期1315.49万股,企业新闻票是有了,怎么来看展?这篇交通指引不看吃大亏!!HOSTOYO防晒服 让探索的勇气不被烈日束缚洛阳玻璃子公司获相关部门补助约223.4万元,企业新闻玻璃瓶罐的化学原料成分 怎样才算高质量玻璃瓶罐,行业资讯福建福州:开办企业再提速 全流程一日内办结原湖南省省长周伯华一行莅临醴陵电子走访调研,企业视界四种脐橙处理方式对脐橙果酒挥发性成分的影响(三)美国福耀玻璃工厂现状 已经连续两年实现盈利,企业新闻第35届亚太网印数码印花展5.16与您相约广州!福建德化:巧用“红蓝绿黑”四色积极战疫ETTOI 爱多娃上新 夏日狂想曲进行时静电玻璃贴膜有什么特点 玻璃表面的窗花如何去除,行业资讯四种多糖代替明矾改善红薯粉的品质特性(二)小象Q比2025春夏新品 童年的烂漫 在细碎且温柔的日常里棉果果QtonBaby 时尚小裙子 给你纯真的烂漫广州货物9月19日玻璃期市评论,期货知识2024EFB上海服饰供应链新征程启航,邀您共拓服饰蓝海以颜色玻璃为打破口 掀起全行业“去非标”行动,政策解读山豆根的化学成分和药理作用的研究进展(一)福建厦门:全力护航学校复学防疫及食品安全无框玻璃门要怎么装门锁 无框玻璃门安装参考步骤,行业资讯光伏玻璃“火了”!十大光伏玻璃企业一览,行业资讯传苹果明年导入Mini LED技术,将包下晶电相关产能?,市场研究磺胺甲恶唑标准品:医药检测关键对照品怀孕几天能测出来,怀孕初期应该注意什么四个月可以添加什么辅食(宝宝辅食添加指南)11种观赏百合营养和功能品质研究(一)2种金属元素混合溶液标准物质(钼、银):同时测定钼银元素新选择深圳出台新政扶持新材料产业:要点支持新材料产业这5大领域,政策解读南亮股份防火玻璃科技系统再添新成员:新型硅类复合防火玻璃,企业新闻陕西渭南2×300吨光伏玻璃生产线项目建成试产,行业资讯蒙药砂蓝刺头定性与定量质量控制方法研究(三)杨春香丨对幼儿棋类游戏的观察与指导河北邢台:全力保障市民用药和质量安全运动时尚 G刻碰撞 GOFE 2023 运动时尚潮服展重磅来袭高氯酸滴定溶液标准物质(以水为介质):精准标液,滴定分析权威之选影响中空玻璃热熔胶封边质量的五大重要因素,经验交流兰卓丽独家冠名2025第十二季SIUF国际超模大赛圆满收官天津河东:落实“132”机制助力企业发展1月天猫数据曝光 这个品类销售额增长51% 数据看趋势不同产地大马士革玫瑰精油成分比较与分析(一)发改委:8月份建材行业运行情况,产业数据金肚兜奖·中国内衣行业年度颁奖典礼盛大举行水果和蔬菜中抗蚜威残留检测的不确定度评定(二)天津市场监管委领导调研复工复产工作小猪班纳轻舒衣千恤系列 休闲有型挡风玻璃为何能裂而不碎 怎样挑选高质量夹层玻璃,行业资讯浙江温岭:开展质量安全进校园活动玻璃价格预期依然较弱,关注环保限产具体落实情况,行业资讯广西梧州开展食品安全快检 守护市民“菜篮子”安全固液分离和沉淀的洗涤(一)棉果果QtonBaby 新学期 重新演绎时尚与个性 拒绝沉闷厚重北京石景山:“一码检查”工作实现全流程电子化管理重庆出台10条措施 赋能检验检测新质生产力发展重庆市市场监管局开展食品快检技能竞赛铬酸钾溶液:高纯度试剂,用于多种化学分析与实验甲醇中乐果溶液标准物质:农药残留校准的专业标准物质玻璃幕墙怎样安装 钢化幕墙玻璃的特性,行业资讯江苏:认证认可检验检测助企降本增效广西:开展化妆品安全使用知识宣讲活动吉林:严查食品市场守牢安全底线天津:专项整治电动自行车违法行为拼镜玻璃装饰有哪些优点 玻璃拼镜能带来哪些方便,行业资讯Supreme单品预告 杂志封面的衬衫 你爱了吗?隔音玻璃的种类与价格 隔音玻璃还有什么其他的功能,行业资讯Winberg回归 参与主演Filippa K 2023春夏新品大片马拉丁童装 明媚春日这样穿 清爽休闲ICP—AES法测定硫酸钯中的二十二个杂质元素水(二)浙江杭州:开展乘梯安全伴“童”行活动Andy & Evan衬衣单品 休闲百搭 时尚且流行玻璃展示柜有哪些类别 玻璃的制备工艺过程,行业资讯汽车玻璃隔热膜有哪些类别 汽车玻璃膜怎么挑选靠谱,行业资讯常春藤「开学战袍系列 解锁校园社交密码Diptyque推出纸上香水 Fabrice Pellegrin以谷物为起点玻璃通常厚度是多少 幕墙玻璃的保养方法,行业资讯市场监管行风建设在行动玻璃价格高位震荡,关注行业冷修进展,行业资讯七彩芽 用色彩装点童年的纯真美好北京:严查高考、端午及暑假期间价格违法和不正当竞争行为食品添加剂问答之食品添加剂的使用(一)食品及食品污染溯源技术与应用的二维条码(六)河北唐山:一路“童”行 守护孩子的“吃穿用玩”硫酸亚铁铵溶液标准物质:铁离子含量校准的专业基准加强召回 助力发展明知故犯 商户非法改装电动自行车被列入“严违失信”Collina Strada 2023春夏系列 把春天的温柔和生机穿上sacai x WTAPS初次联名发布 军绿色山系户外系列Stussy 2023预计本周发售 跟着一起入手吗?江西集中销毁货值1200余万元的侵权假冒伪劣商品水中亚硫酸盐(亚硫酸根)溶液标准物质:环境监测与水质分析的校准基准孕前调节饮食食谱一周几次食品及食品污染溯源技术与应用的二维条码(四)高效液相色谱法同时测定四川豆瓣中安赛蜜、 苯甲酸、山梨酸、糖精钠及脱氢乙酸(二)玻璃要经过哪些生产工艺 使用玻璃作为包装容器的优点有哪些,行业资讯广西融安:开展高考考点学校及周边食品安全检查浙江省湖州市市场监管部门提醒:当心“手工制作”的化妆品是“三无”产品理想同学App宣布已接入DeepSeek R1满血版JJJJOUND x Salomon联名曝光 预计夏季发售福建全力保障中高考期间价格秩序稳定和饮食安全有贴在玻璃上隔音的隔音膜吗 隔音玻璃能防止噪音吗,行业资讯上海:多部门联合化解装修合同纠纷 助力消费者退回30万元时尚暴击!Andrew Chiou再出动漫游戏跨界系列区域尺度的食品化学性污染源贡献率估算技术(一)保护知识产权 激发创新活力LITTLE CREATIVE FACTORY气质感穿搭 塑造挺括身形家具玻璃的种类 玻璃家具的保养方法,行业资讯Salomon携手CDG联名发新 黑白双色也很有型ETTOI 爱多娃 浪漫和优雅的交织 构筑童年的绚丽美好广东部署开展放心消费十大行动NECK & NECK时尚童装 用温暖充盈春日美好啄木鸟:春日童装秀场 T恤唱响时尚主旋律食品及食品污染溯源技术与应用的二维条码(三)MINI A TURE保暖系列 简约户外 构造森系自然风钢化玻璃还可以磨边吗 有哪些玻璃加工设备,行业资讯Awake NY x ASICS 联名 GEL加强标准引领和质量支撑 服务社会经济发展江苏抽检端午热销食品3065批次 整体安全状况良好速度与激情 EYTYS 2023秋冬系列演绎经典切勿轻信高价志愿填报咨询服务广东举办第三年度“内外贸检测认证知识大讲堂”无证生产温泉蛋 朝一蛋品被罚同一功能的食品添加剂混合使用在元宇宙开店 THOM BROWNE等开始出售虚拟服装Il Gufo时尚童装 聚焦热点 让简约成为你的标配吉林大安:向医疗美容行业广告违法行为“亮剑”罗伯特·卡沃利时尚童装 洒脱而不失率性ANNIL安奈儿 牛仔也可以很柔软细腻Tom Sachs塌房?传闻是捏造还是实事求是太阳能热水器玻璃管怎么拆 全玻璃真空管的构造,行业资讯广西梧州开展毛绒玩具专项监督检查以纯童装 用格雷系的简约休闲 开启校园活力手足口病治疗最有效的药物是什么,手足口病治疗注意事项有哪些?Jordan Brand Tatum 1 预计6月20日发售儿童袜怎么选?杭州市市场监管局给出指南钢化玻璃的爆开率是多少 怎样避免钢化玻璃爆开,行业资讯玻璃生产企业回笼资金为主,行业资讯厨房橱柜玻璃门好不好 厨房的橱柜门用钢化玻璃好不好,行业资讯玻璃管有什么特点 玻璃管的组成原料,行业资讯乙酸铅滴定溶液标准物质:铅离子检测的精准校准溶液岚图梦想家发布华为乾崑智驾新版型,售价35.99万元起玻璃市场弱势运行为主,存在价格回落可能,行业资讯值得入手的新品好物 Human Made夏季系列时髦兼具品质浙江嘉善:聚焦三个领域 护航多彩“六一”久岁伴 见证孩子的快乐童年 纯真溢满美好重庆江北:开展检验检测机构开放日暨消费体察活动问界回应长沙M9失火事件:未造成人员伤亡,车辆电池包未起火、未燃烧稀硫酸溶液:高效精准化学实验必备溶液区域价格调整,市场趋于谨慎!,行业资讯浙江经营主体达1095.17万户福建:启动节前安全检查 守护节日市场秩序广西南宁12315春节期间接收消费者投诉举报377件Levi's调整领导结构 以更好应对当下复杂多变的市场行情吉林:节日护航“不打烊”汽车玻璃升降器怎么维修 汽车车窗玻璃贴膜的好处,行业资讯浙江嘉兴经开:推行外资企业首席质量官制度助力发展创新H&M集团战略调整:Monki品牌全球门店将关闭 业务整合至Weekday黑龙江发布11项冰雪经济领域地方标准双层夹胶玻璃是什么玻璃 夹层玻璃主要有什么作用,行业资讯玻璃切割片具有什么优点 如何手动切割8mm玻璃,行业资讯备孕期间的鹿茸杜仲作用、禁忌与专家解读麦麸酚酸类物质对面团聚集态的影响(二)广西南宁创新开展药品网络销售抽检安踏2025蛇年“好事发生”新春系列全面上市客厅里放玻璃茶几好不好 玻璃茶几有什么挑选方法,行业资讯采光不用电 玻璃能隔热 郑州奥体中心体育馆场级别不输NBA,行业资讯湖北宜昌开展羽绒制品质量专项检查欧莱雅美国宣布出售Carol's Daughter品牌蓝色钴玻璃为何是蓝色的 为何焰色反应要蓝钴玻璃,行业资讯8月19日玻璃行业本周数据跟进,产业数据2019年上半年中国TV市场总结:增长停滞 头部品牌集中度提升,行业资讯玻璃怎样镀银来制作镜子 玻璃镜子分成了哪些种类,行业资讯两种甜叶菊废渣提取物对D玻璃钢化炉主要组成部件 钢化玻璃生产的常见问题,行业资讯五省(区)国产婴幼儿配方乳粉监管工作交流会在哈尔滨召开伟业国标:抗氧化剂和添加剂标准物质系列玻璃切割片具有什么用处 玻璃切割片具备哪些优点,行业资讯玻璃价格涨势趋缓,削减库存为主!,市场研究玻璃加工有哪些常用设备 成品玻璃需要做哪些加工,行业资讯9月2日国内期市日间盘多种主力合约涨幅超2%,行业资讯国内玻璃现货市场稳中上探,市场研究门窗玻璃松动该怎么固定 汽车玻璃密封条怎么制作,行业资讯备孕期间的甘草饮用福利、注意事项及正确方法中国首条大尺寸OLED面板生产线量产 OLED电视能否借机逆袭?,市场研究内分泌失调导致的痘痘怎么根治(有效的治疗方法和注意事项)玻璃保鲜盒用的什么玻璃 耐热玻璃的加工制作方法,行业资讯废玻璃应该怎样回收利用 如何检验压花玻璃的质量,行业资讯用玻璃瓶制作包装好不好 玻璃瓶分成了哪几种类别,行业资讯浙江杭州萧山区:加大监管力度 守护节日烟火气备孕成功的秘诀:早起调整技巧与每日重要性Loewe新春献礼:景泰蓝艺术融合时尚 共庆中国新年广西防城港:专项检查烟花爆竹江苏:多措并举擦亮“放心消费在江苏”名片Amer Sports(亚玛芬体育)2024财年Q3业绩强劲花旗银行上调Prada目标价 看好亚洲市场强劲表现Oysho中国内地市场再遭重创 最后一家门店即将关闭福建:持续推进校园食品安全工作走深走实落地玻璃要怎么施工安装 落地玻璃装饰多少钱一方,行业资讯福建宁德:全力守护“舌尖上的年味”Safilo集团与Dsquared2眼镜系列续约至2031年玻璃:持续震荡,市场研究聚焦高端节礼市场 福建多地开展纠治商品过度包装执法检查伟业国标:金属溶液标准物质系列广东惠州:积极开展社会公益活动窗户玻璃贴膜起到的作用 窗户玻璃贴膜有哪些好处,行业资讯该怎么对隔音玻璃做挑选 落地玻璃窗尺寸多大合适,行业资讯湖北省市场监管局提示:警惕火漆印章存在烫伤风险Hugo Boss童装系列续约CWF 共绘时尚蓝图至2029年杭州桐庐“三码合一”助企高质量发展广西凭祥:强化边境旅游景区监管 确保春节市场秩序稳定女性不排卵的原因及相关知识介绍Karl Lagerfeld 品牌将于 2025 年重返 Pitti Uomo 男装贸易展会如何施工安装玻璃隔断墙 背景墙彩绘玻璃该怎么做,行业资讯玻璃怎样固定在水泥墙上 屏风玻璃怎样安装才安全,行业资讯外墙玻璃用哪种效果更好 钢化玻璃和白钢玻璃区别,行业资讯玻璃东北会议召开,提振信心为主!,行业资讯玻璃磨边工作流程是什么 玻璃磨边机使用注意事项,行业资讯陕西:强链补链精准施策 助推羊乳产业高质量发展广西龙胜:紧盯年货一条街 守护市场“放心购”名创优品集团2024年Q3财报亮眼 海外业务持续强劲增长Marni × HOKA 重塑经典 定义时尚运动新风尚黑龙江哈尔滨:守护新春“团圆味”电子烟烟液中游离态和质子态烟碱的测定及分布(四)山姆中国:会员驱动下的强劲增长 未来可期Puma实施成本削减计划 全球裁员500人怎样才能使UV胶快速固化 使用UV胶粘接要注意什么,行业资讯Nike旗下RTFKT Studios宣布逐步关停业务Puma在德国总部开设Studio48创意中心二氧化碳中全氟异丁腈气体标准物质的研制(一)环境监测实验室“废液”的科学处置探讨(二)广西宁明:把好民生计量关 “秤”心如意过春节玻璃胶的固化时间要多久 玻璃胶完全凝固所需时间,行业资讯蒙牛有婴儿奶粉吗?蒙牛婴儿奶粉种类及价格介绍怀孕15周胎停几率大吗,胎停的原因和预防措施黄金饰品怎么买?福建市场监管部门给出“避坑”招数耐克业绩承压 或将采取更积极的应对措施Crocs与Peanuts联名 时尚溢满童真意趣拼多多旗下Temu跨境电商平台在法国市场迅猛崛起Louis Vuitton与Kari Voutilainen再度携手重污染天气玻璃等行业应急减排措施出台:A级企业免于停限产 B级企业限产20%,行业资讯生意社:传统旺季到来 玻璃强势上涨(8.12群创:面板产业还在寒冬,减产是普遍现象,行业资讯怀孕生男孩的征兆(讨论孕期男女宝宝的预测方法)湖南培育放心消费承诺单位5.64万家生意社:本周玻璃小幅提涨 市场需求略有增加(8.17钢化玻璃材料内部含铅吗 怎样辨别认出含铅玻璃杯,行业资讯二氧化碳中全氟异丁腈气体标准物质的研制(二)浙江绍兴深入治理农村食品安全风险隐患辽宁召开药品监管工作会议部署2025重点任务幼儿简笔画100种图片教程,让宝宝轻松学会画画方法2030年6G将会商用 王建宙:要加快定义和研发北京首例比特币合同案一审宣判:合同无效德甲:多特蒙德胜菲尔特朗诗地产:向成都德商荣达置业注资3000万元无惧涨价 特斯拉车卖疯了:车管所“一眼望去全是它”汇丰人寿董事长、总经理双双更换,今年前三季度亏损上亿詹皇24分山村科比准绝杀 湖人加时险胜独行侠NYMEX原油短线或升向73.53美元美联储12月决议机构评论汇总固态电池和e-POWER将成为日产电动转型的基础一个比一个浮夸,回看2021年的雷人演技,你们还是找个厂上班吧虞书欣粉丝太疯狂 深扒网友身份 强迫学校将这位学生开除多家企业宣布调整钛白粉价格OPPO Find N:折叠生态的头部争夺战国轩高科:大众中国持股比例增至26.47% 成为公司第一大股东兰州银行“破净”发行 预计募资总额超20亿元拿什么终结一些APP“上船容易下船难”?12月16日黄金交易策略:关注布林中轨阻力1789钛白粉价格明年继续涨 或成化工市场最大赢家?工业信息安全产业保持高景气度 市场整体规模将增至167.01亿元我在转转经历了最深的套路汪雷:房地产行业对于经济稳增长的作用依旧不可忽视中俄高校携手共建冬奥会冰雪运动训练研究基地自动驾驶卡车企业Aurora与Uber Freight成立试点项目美“帕克”探测器首次“触及”太阳马斯克:贝索斯太把自己当回事儿“天宫课堂”点亮科学梦想解决电动车冬季续航难题 比亚迪海豚十万也能拥有热泵空调自主研发实物教具 让职业技能培训更高效新疆沙湾市举办多项冰雪活动助力北京冬奥会“钻石的缺陷”为量子计算机提供完美接口巴萨为阿圭罗选择替身 卡瓦尼奥巴梅扬二选一青岛:倒计时50天 为冬奥加油溢价8倍收购实控人旗下公司 精研科技遭深交所“10连问”新秀榜:探花稳居榜首 状元上周爆发场均21+4+4李霄鹏考察球员重点后腰右后卫 寻找新人立足未来建筑信息建模技术为隧道建设装上智慧大脑OPPO推出自研芯片,手机四巨头芯片赛跑 国产高端手机谁能接棒?卡培拉首次打老东家感觉很怪 竟然忘了圆脸登比亚迪宋PLUS车系登顶11月全国A级SUV上险冠军羡煞旁人!阿里推出多项员工福利,现在投简历还来得及吗?数千元便可搭建上线 低俗中小直播平台泛滥短池游泳世锦赛即将揭幕 全红婵将首次“跳海”CXO暴跌、基民集体“关灯吃面”,970亿规模的葛兰还能追吗英媒列曼联引进哈兰德3大优势:朗尼克C罗桑乔欧洲央行决议来袭,换个方式QE+下调经济预期?警惕欧元再次下行又道歉了?要点脸!“未来之城”什么样?北京经开区描绘出雏形90%半导体技术和工艺被美日掌握 盛希泰:要用做原子弹的决心做芯片弗格森的恐惧!舒梅切尔爆料:爵爷最怕此人95后四小天王出炉 曾经不被看好的王一博 逆袭之路堪称典范别了,智能手机时代业绩补偿承诺又没得到履行 连续并购的东旭光电前路何在?国际金价受益于美元续回落,央行大戏等待欧洲玩家解棒男星也集体扮嫩,35岁尹正演14岁少年,刘恺威满脸褶子河北滦州:冰雪运动进校园西甲德甲英超轮番称霸!他才是当今教练的天花板武磊收获赛季的第一个进球打破了342天的进球荒淘女郎落幕了南极洲“末日冰川”关键冰架或在5年内坍塌当心!一些“元宇宙游戏”“云挖矿”APP成诈骗陷阱淘女郎落幕了易烊千玺首次晒胡须照 面部苍老显颓废 素颜状态似大叔姚明明恋情曝光?前女友爆大尺度床照 直指男方玩弄她身体!巴萨为阿圭罗选择替身 卡瓦尼奥巴梅扬二选一男星也集体扮嫩,35岁尹正演14岁少年,刘恺威满脸褶子赵丽颖王一博被上面针对?程潇拍一部扑一部?向涵之模仿李庚希?67元买回的股票1元卖?苏泊尔股权激励方案遭监管质疑利益输送弗格森的恐惧!舒梅切尔爆料:爵爷最怕此人【专访】贝多广:普惠金融的目标就是从“金字塔社会”转型成“橄榄型社会”数字基础设施用电量日益凸显 莫让新基建变成“吃电”大户华晨宇樊博艺恋情曝光?3000万顶流还没完 谁将是下一个接盘侠?补贴将退坡 年前赶购新能源汽车?创业投资如何在无人区生存发展?刘二海:要关注生存环境的变化90%半导体技术和工艺被美日掌握 盛希泰:要用做原子弹的决心做芯片阿媒:阿圭罗将会参加世界杯 换个身份携手梅西说他是唯一的“五代神颜”?字节内测“汽水音乐”App,在线音乐市场再现“三国杀”宣亚国际“傍上”元宇宙20CM三连板 市盈率为负值偏离同行业平均水平马斯克称没有CEO比他更关心安全新秀榜:探花稳居榜首 状元上周爆发场均21+4+4现在吻戏的内卷标准是这样的?美股周三收高 美银称当前美股与2000年科技泡沫相似长视频网站遇困,爱奇艺难逃“宿命”?英媒列曼联引进哈兰德3大优势:朗尼克C罗桑乔国货之光比亚迪再出精品 海豚超强冬季续航令人喜爱!券商并购为何总是 “干打雷不下雨”?李霄鹏考察球员重点后腰右后卫 寻找新人立足未来台积电索尼将在日合建芯片厂 能为日本“硅岛”带来新生吗?英媒:朗尼克可能拿下B费 让范德贝克与他竞争短视频带货 近八成受访者最关心商品质量火箭主帅首节因病离场 半场崩溃落后31分之多续航久的高颜值车 比亚迪海豚符合消费者的购车需求!创投进入无人区?刘二海:要开辟赛道 而非仅在赛道上挑选手兴隆新材拟挂牌新三板:属重污染行业 近年毛利率持续下滑受妖股炒作情绪传导 华研精机实际涨幅最大超300%央行副行长刘桂平谈共同富裕:金融赋能民众实现财产保值增值作用有待深化何炅人设崩塌 快乐家族全体翻车 湖南台的主持人都穷疯了吗?41岁章子怡不抗老?脸部塌陷皱纹明显 网友:像老太婆比亚迪海豚 冬日续航新擂主!创造销量新奇迹!银河系中心黑洞质量有了最精确测量压力大全靠怼来发泄?光伏、半导体等行业频现卖方分析师互怼“超前点评”,注水的伎俩总有被戳穿的时候三个跌停后是三个涨停!两倍大牛股被立案调查 却挡不住股民热情英超:阿森纳胜西汉姆联英媒:朗尼克可能拿下B费 让范德贝克与他竞争互联网的创新,太无聊了疫情担忧再起!苹果无限期推迟复工 并关闭北美三家门店电气化转型或致法国汽车业裁员30%DataMesh马谦:寻找元宇宙维度下的技术路线或场景创业是很好的时速40公里!脚印“知道”这恐龙跑得有多快价格不贵又充满乐趣 比亚迪海豚冬季表现不错袁冰妍多次撞衫赵丽颖?被网友嘲讽刻意模仿 热度这么好蹭吗?元宇宙又生出新花样 NFT走热背后藏风险关晓彤颜值再遭吐槽?拍摄新广告动作销魂 网友直呼太油腻穿过日冕 “帕克”探测器首次与太阳亲密接触亚玛顿关联重组标的股权密集变动 产品价格下跌扣非净利降逾70%浓眉哥下一场就可能复出 已经歇了近一个星期詹皇快37岁还要当大腿 要不是他湖人几乎必输生物医药股突遇“黑色星期三” 药明康德暴跌 CXO概念成重灾区全年的笑点都在这了…别了,智能手机时代英大期货与2责任人收警示函 居间人管理内控缺陷严重华为云助力卫星进入“智能机”时代自动驾驶距大规模商用还有多远OPPO推出自研芯片,手机四巨头芯片赛跑 国产高端手机谁能接棒?金融街物业现金流充裕 加速收并购两月成立三家合资公司DataMesh马谦:绝大部分的创业者还是要在内容上创业国米队长:卢卡库走了就不行了?错!我们更强了最高浮盈已翻倍!百亿私募177亿豪买“打折股”,战绩如何?全年的笑点都在这了…直击上市发布会!百济神州高管层回应破发:未来几年进入密集收获期工业领域数字化场景不断丰富 数字应用程度不断加深拟67元回购1元卖 股权激励涉嫌利益输送 苏泊尔收深交所关注函良种配良法,破解长江流域棉粮争地难题IPO雷达 | 海康威视分拆萤石网络冲科创板,行业竞争加剧,公司存货大增卡培拉首次打老东家感觉很怪 竟然忘了圆脸登火箭主帅首节因病离场 半场崩溃落后31分之多刚20CM涨停就收关注函!这家公司蹭上元宇宙概念?3年没接一部戏的她 最后悔去整容 差一点断送演艺事业名嘴:阿尔特塔太可耻了 奥巴梅扬是去探望母亲44次北斗发射百分百成功九安医疗收监管函 28个交易日走出15个涨停12月16日汇市观潮:欧元、英镑及澳元技术分析演员控诉《龙马精神》剧组 拍戏胸椎骨折无人问 对方只赔3.5万国际奥委会高官:奥委会是小组织 选中国不后悔西媒:38岁的阿尔维斯配得上主力 他是巴萨最佳英媒:鲁尼有望执教英超球队 将接替贝尼特斯谢霆锋王菲还未分手?回京后迅速前往王菲爱巢 与张柏芝复婚无望国际金价短线料进一步升向1800美元2974!库里加冕新的NBA三分冠军传奇告别!穆里奇离开中超 曾随恒大一起创造历史刘烨9岁女儿曝光 越来越像外国人?和她爸爸完全两个模样看呆!阿尔特塔骚操作!强行把大将拉进场内卧草西媒:38岁的阿尔维斯配得上主力 他是巴萨最佳揭秘北京冬奥会体育图标:像“印”不像“标”?中国大妈后继有人,90后疯狂薅金:一口气豪买27件马斯克:贝索斯太把自己当回事儿现在吻戏的内卷标准是这样的?西甲德甲英超轮番称霸!他才是当今教练的天花板揭秘穆帅子女!女儿设计珠宝获奖 21岁儿子当教练技术何时该产业化? 投资人刘二海给出时间点33岁倪妮穿低胸长裙大秀性感 却意外暴露出身材 网友:胸太小黄金市场分析:美联储加倍减码 黄金先抑后扬昔日青海首富取保候审 藏格矿业56亿卖股还债腾讯游戏首次透露“未成年人防沉迷”进度,推进仍面临技术与理念挑战OPPO Find N:折叠生态的头部争夺战鼓掌!阿森纳杀回英超第四名 终于回到老位置通鼎互联30亿豪购致扣非两年亏25亿 29亿短债悬顶密集卖子卖地救急互联网的创新,太无聊了中科院如何理解“元宇宙”?有四个关键词特斯拉将获美国警队大单,纽约警局考虑采购250辆Model 3说他是唯一的“五代神颜”?冬季续航测试严峻 比亚迪海豚实力不容小觑海上丝绸之路时间中心建设获进展AI产业和产业AI不断发展 智算基础设施建设热度持续升高WCBA综合:四川保持不败金身 张敬一50分闪耀全场460万投资者涌入 北交所开市“满月”成绩单出炉供应链是如何影响美国通胀的?自动驾驶正快速发展 距大规模商用还有多远李小璐深夜晒美照撞脸刘雨欣?疑似再度整容 网友直呼认不出揭秘穆帅子女!女儿设计珠宝获奖 21岁儿子当教练湖人半场遭逆转处下风 詹姆斯险受伤虚惊一场门兴遭遇四连败 多特战胜菲尔特澳洲贝拉米奶粉好不好 现在的贝拉米属于蒙牛旗下吗?祝绪丹遭杨幂雪藏?发博后秒删 疑似内涵杨幂对公司不满中超综合:青岛队刷新中超连败纪录斯巴鲁因变速器问题在美召回近20万辆汽车断臂求生、回归主业?昔日“冰箱出口大王”欲1元变卖家产搭上“北斗”羽绒服竟卖上万元?是成本涨了还是大厂在炒作?爱奇艺会员费再度上调,这回是加价不加量深圳房贷利率新变!部分中小银行降低按揭贷款利率,国有大行暂未跟进12月16日美原油交易策略:关注下行趋势线压力专家预测可折叠iPhone三年后面世,三星已占93%折叠手机市场快看 | 因在山东胜通等评级工作中出现失误,大公国际领交易商协会处分 12月16日你要知道的15个股市消息|投资简报清源集团发债违规马之清收警示函 关联交易披露不完整青岛出台园区培育计划 科技项目最高支持500万元OPPO刘作虎:没有一款完美的产品 屏下摄像头我还不满意郑恺:我们都戴上了“面具”守牢食品安全!上海松江“你点我检”走进爱心暑托班紫苏叶挥发油化学成分及其药理作用研究进展(三)一株猪源植物乳杆菌在青贮饲料中的应用研究巴拉巴拉夏日新品 让童装满载新潮与活力!广西玉林:加快推进食品检验联合实验室建设玻璃砖的尺寸规格怎么选 玻璃砖砌筑墙体有何方法,行业资讯盛夏将至 选择爱法贝2025夏季新品 浪漫时尚盲盒并非监管“盲区”北京海淀严查假冒盲盒PPB级守护:伟业计量空气毒害物标准物质全面升级,构筑职业健康智能防线最高罚款40万元!上海公布2024年守护行动第一批典型案例玻璃厂家提价促销,市场信心谨慎!,行业资讯越南某违法骨关节保健食品被查获福建福州:深入推进电动自行车安全整治汽车玻璃划痕要怎么修正 汽车玻璃有刮痕怎么处理,行业资讯五一假期将至 河南发布餐饮安全消费警示乙醇水中甲醇溶液标准物质:满足多组分溶液分析需求“湾区认证”委托认证服务签约仪式举行安徽市场监管部门今年以来查办案件3.62万件车内玻璃上怎样避免起雾 挡风玻璃上有雾气怎么办,行业资讯热反射玻璃隔热效果原理 有色玻璃可以隔热保温吗,行业资讯调光玻璃材料有哪些功能 调光玻璃材料该怎么选购,行业资讯五项茶类饮料团标公开征求意见,助推茶产业有序发展光学玻璃的主要生产过程 光学镀膜玻璃该如何清洗,行业资讯广西崇左:“两代表一委员”走进餐饮一线监督食品安全抽检活动UPLC/MS/MS法测定饮料中甜蜜素、糖精钠和安赛蜜(二)玻璃酒瓶一般怎样生产的 如何选择优异的玻璃酒瓶,行业资讯玻璃杯怎么挑选质量更好 玻璃瓶生产工艺主要流程,行业资讯玻璃加工机械的主要类型 玻璃磨边机使用注意事项,行业资讯低熔点玻璃粉的主要参数 低熔点玻璃粉的理化性能,行业资讯福建三明举办消费者权益保护工作业务培训班浴室玻璃淋浴房怎么清洗 玻璃上的顽固水垢怎么除,行业资讯未凝固玻璃胶要怎么清理 怎么用玻璃胶来固定玻璃,行业资讯制作玻璃主要材料是什么 玻璃生产工艺流程是什么,行业资讯济南:“以案说法”解读节日食品里的“法律密码”装饰玻璃隔断的防火等级 玻璃隔断具有防火功能吗,行业资讯狮子、棕熊、玳瑁制品也敢卖?市场监管部门严查沙河:推动新时代玻璃产业高质量发展,企业新闻江苏发布互联网平台销售人脸面具等相关产品提醒告诫函采购土豆农药残留超标 春晖颐老年公寓被处罚玻璃地板铺设装修的步骤 钢化玻璃可以作为地板吗,行业资讯玻璃市场成交尚可,厂家提价促销!,行业资讯光学玻璃材料种类与区别 生产光学玻璃的主要原料,行业资讯孕前3个月饮食减肥方法辽宁本溪:靶向施治 确保无堂食外卖食品安全欧盟评估牛蒡根提取物作为猫和狗饲料添加剂的安全性和有效性天山雪莲细胞培养技术、化学成分和药理作用研究进展 (四)洛阳玻璃一季度净利199万元同比下滑72%,企业新闻湖北武汉:为特种设备“体检”湖北上半年新登记经营主体97.91万户氧化镁溶液标准物质:精准测量溶液浓度黑色烤漆玻璃做装饰好吗 黑色烤漆玻璃的材质特点,行业资讯精准管理长江渤海黄河排污口 年底前完成试点地区排污口命名编码并竖牌玻璃提价范围增加,提振信心为主!,行业资讯钛元素溶液标准物质:助力金属元素分析精准可靠四川成都上线知识产权“两超一集” 一站式服务创新主体预计节日期间玻璃市场降成稳中偏弱,行业资讯浙江嘉兴知识产权全链保护入选全国优化营商环境典型案例iPhone XR2后盖玻璃、渲染图曝光:新增绿色和薰衣草色,行业资讯广西壮族自治区市场监督管理局 食品安全监督抽检信息通告梦幻童年 IVY HOUSE常春藤精选公主裙绽放纯真魅力!广西防城港销毁价值900余万元的假冒伪劣商品6家粤企特种玻璃加工企业来邵考察洽淡,企业新闻假黄皮中化学成分及其抑制滑膜成纤维细胞增殖活性研究(一)提升女性生育能力的有效途径:轻松备孕中的正确内膜运动技巧巴西,一座“透明结构”的梦幻别墅,你敢住吗?,企业新闻水晶玻璃材料都含有铅吗 水晶与玻璃应该怎么区别,行业资讯一种草莓青柠西打酒的研制(二)杠香生药学鉴别研究(三)山东肥城:开展肥城桃知识产权保护专项执法行动水中氰化氢溶液标准物质:为环境监测提供可靠基准男性备孕加速计划:跳绳锻炼指南,提高生育效率贵州蜡梅属药用植物化学成分和药理作用研究进展(一)夏日预备 SunTomorrow打造宝贝满分出场!叮当猫:30载守护童真 传递爱与温暖ETTOI 爱多娃 春夏时尚甄选 甜美而灵动 演绎美好童年玻璃吊带搬运有什么优点 玻璃吊带搬运的注意事项,行业资讯如何用玻璃刀来切割玻璃 切割后的玻璃要怎么磨边,行业资讯高粱杂交种茎叶产量与能源品质性状相关性分析(二)福建持续推进药品安全专项行动走深走实玻璃区域价格上涨,提振信心为主!,行业资讯北京通州:数字化监管守护开学“第一餐”中空百叶玻璃是什么材料 中空玻璃百叶门窗的优点,行业资讯液晶玻璃基板是什么玻璃 浮法玻璃的生产制造工艺,行业资讯白薇化学成分及药理作用研究进展(二)理想汽车2025年销量目标70万辆?官方暂无回应福建:紧盯肉类食品安全 让百姓吃上“放心肉”玻璃整体供给压力持续增加,逢高做空,行业资讯“荆楚个体通”上线 湖北启动第三届“个体工商户服务月”涉嫌违法违规 哈尔滨8家酒类专营店被立案调查厦门食药检院通过CNAS实验室认可复评审和扩项现场评审UPLC/MS/MS法测定饮料中甜蜜素、糖精钠和安赛蜜(一)昨日重现:玻璃梦回2016,企业新闻职场女性备孕二胎:家庭与事业抉择,如何重新定义自己的人生北京东城:专项检查老字号旅游餐饮单位雷军公布小米汽车开店进展:全国已有235家门店,4月计划新增33家门店416米幕墙外衣还原“古城墙”,企业新闻傣药竹叶兰研究进展(一)最新通报!安徽5批次草莓、韭菜、鸡肝等检出不合格正己烷中七氟丁酸酐溶液标准物质:满足特殊化学分析需求的深度探讨浙江海宁:产品质量加油站打造质量监管服务新模式江苏南京:召开“黄金珠宝放心购”消费者权益保护指引团体标准编制研讨会环境监测中化学需氧量的检测过程及展望京津冀限产令即将再度来袭,你准备好了吗?,行业资讯大部分国家单体废玻璃加工基地开工,行业资讯南湖菱护色工艺研究(三)基于血清药物化学与网络药理学探究麝香通心滴丸治疗冠心病的机制(一)什么是夜光玻璃 夹胶玻璃该怎么选购,行业资讯真空玻璃的优点 玻璃清洗液的特点与效果,行业资讯金正恩视察玻璃厂 5个字的叮嘱让韩媒猜了半天,行业资讯怎样擦玻璃快速又干净 如何快速撕掉大片玻璃上的贴膜,行业资讯基于血清药物化学与网络药理学探究麝香通心滴丸治疗冠心病的机制(二)玻璃可以防辐射吗 防辐射玻璃的工作原理,行业资讯冰柜双层玻璃门怎么拆卸 冷柜玻璃门起雾怎么办,行业资讯752C紫外可见分光光度计维修实例(二)硅酸盐和磷酸盐玻璃区别 玻璃的主要材料有哪几种,行业资讯钙类食品添加剂滴定检测方法研究进展玻璃市场发展趋势,市场研究铁碳微电解对餐具清洗废水处理的初步研究毛细管柱气相色谱测定食品中甜蜜素的研究进展怀孕吃什么保健品(孕妇保健指南)《雄安新区绿色建筑发展方案》通过验收,行业资讯FGF-23和糖尿病血管并发症的关系高压微射流制备叶黄素纳米乳液及稳定性研究(二)食品营养强化剂β一葡聚糖及其标准化现状与发展建议(二)超高效液相色谱一串联质谱法同时测定焙烤食品中9种水溶性添加剂的研究(二)中药复方药效物质及作用机制研究进展(二)浮法玻璃窑工作原理 玻璃是怎么做的,行业资讯Koses开发出直接制造智能手机用曲面盖板玻璃的印刷设备,企业新闻上海抽查30批次双层玻璃口杯产品 不合格3批次,行业资讯玻璃瓶是怎么制作的 什么是真空旋盖机,行业资讯钢化夹胶玻璃中的胶片厚度有多少规格 平板玻璃的厚度是多大的,行业资讯华北地区玻璃市场总体走势一般,行业资讯电致变色玻璃的介绍 玻璃电致变色的原理,行业资讯北方地区赶工减少 玻璃库存环比增加,行业资讯建筑玻璃的特性与作用,行业资讯真空吸盘的特点 用真空吊具搬运玻璃好不好,行业资讯玻璃现货市场延续回暖态势,行业资讯「新品速递」无处不在的多环芳烃——测定用标准物质强势推出!北流建铧玻璃(二期)项目举行开工仪式,企业新闻玻璃瓶生产线的生产流程 想生产玻璃瓶需要哪些工艺方法,行业资讯玻璃纸是如何生产的 玻璃贴纸有哪些应用,行业资讯湖北交投建成湖北百个高速公路沿线光伏发电站,行业资讯卫生间门的玻璃坏了怎么办 家用室内玻璃门有哪些种类,行业资讯玻璃杯含铅吗 哪种玻璃材料含铅,行业资讯北方地区赶工减少,玻璃库存环比增加,行业资讯酶辅助超声提取阿尔泰金莲花总黄酮工艺研究(二)怎样在玻璃杯子上刻字 玻璃茶杯该怎么选,行业资讯东方树叶“明前龙井”一瓶难求!这瓶水有何魔力?水解蛋白奶粉哪款好(从营养成分和口感来比较)怎样切割特厚的玻璃 怎样手动切割玻璃,行业资讯皂角刺抗肿瘤药理作用及化学成分研究进展(一)响应面法优化牛舌草多糖提取工艺及其对DNA氧化损伤的保护作用(二)突破备孕困扰:助力美满家庭的必知法宝备孕期间如何应对感冒病毒并提高受孕成功率?酶辅助超声提取阿尔泰金莲花总黄酮工艺研究(三)中融新大成为碧桂园5省玻璃供应商,行业资讯什么是玻璃的应力 钢化玻璃为什么强度特别高,行业资讯超声辅助苦荞中蛋白和黄酮的同步提取工艺(一)食品产地溯源技术的建立及应用(二)科学调整饮食,控制血糖水平,健康孕育2018年11月23日中国玻璃综合指数,行业资讯华星光电t4六代柔性OLED面板产线开始试生产,行业资讯固相萃取一高效液相色谱法同时测定糕点中13种添加剂的研究(一)食品产地溯源技术的建立及应用(一)上海备孕乳腺结节医生推荐,专业服务等您咨询!光伏减反玻璃简介及其标准,行业资讯玻璃熔窑电熔锆刚玉砖使用中的5大注意事项,行业资讯气相色谱法测定馒头中甜蜜素玻璃隔断分类介绍,赶紧get起来吧!,行业资讯黑豆的营养成分解析、备孕中的正确食用方法以及黑豆食谱大公开中国光学玻璃制造行业现状及市场前景分析,市场研究2018年11月29日河北省玻璃价格行情预测,行业资讯单向透过玻璃原理及鉴别方法,行业资讯阿魏酸及其衍生物在食品添加剂领域研究进展(一)玻璃杯去茶垢的方法 用玻璃杯喝开水安全吗,行业资讯什么是玻璃管 玻璃熔窑的类型,行业资讯备孕前必做检查,铜仁哪家医院靠谱?玻璃库存走低趋势仍弱,行业资讯老房子阳台能够装落地玻璃吗 落地玻璃窗怎么节能,行业资讯华中会议召开,提振市场信心!,行业资讯超高效液相色谱一串联质谱法同时测定焙烤食品中9种水溶性添加剂的研究(一)汽车玻璃是否有必要贴膜 建筑玻璃贴膜的优势,行业资讯2018年12月5日山东省玻璃价格行情预测,行业资讯近期玻璃现货市场环比有所好转,行业资讯玻璃瓶罐的质量标准 工艺玻璃瓶的制造步骤,行业资讯备孕怀孕App排行榜:选择最适合你的高准确性备孕神器,轻松掌握生理周期,提高受孕准确性!手机玻璃钢化膜有必要贴吗 卧式玻璃磨边机的构造与功能,行业资讯玻璃胶使用的时候该怎么操作 玻璃幕墙的构成配件有哪些,行业资讯玻璃真空吊具的优势特点 真空吊具吸盘特点的介绍,行业资讯2018年11月21日中国玻璃综合指数,行业资讯中国玻璃综合指数,行业资讯备孕成功的秘诀之一:香蕉的惊人功效揭秘,成为备孕女性的福音!血清药物化学结合网络药理学探讨养心氏片治疗冠心病的物质基础与 作用机制(一)响应面法优化微波辅助桃胶水解工艺研究(二)湖南省六部门就推动绿色建筑出台意见,行业资讯钢化玻璃做地板合适吗 钢化玻璃地板的使用要求,行业资讯固相萃取一高效液相色谱法同时测定糕点中13种添加剂的研究(二)微晶石与微晶玻璃有什么区别 微晶石的分类及区别,行业资讯“一人一业、全力投入”台玻集团,目前主攻ITO玻璃市场,企业新闻有机磷中毒样品的气相色谱皂角刺抗肿瘤药理作用及化学成分研究进展(二)夹层玻璃生产工艺流程,你知道吗?,行业资讯如何避免门窗脱落掉落,经验交流吉林丰满:打好稳价“组合拳”基于纤维素的食品包装材料的研究进展(一)大佬带货掀抢购风潮 旅游直播能走多远?强化安全监管保障 湖北武汉助力学校开学复课一种燃料热沉标准物质候选物的纯度定值及不确定度分析(四)邻居在楼道加装围栏 法院终审判令拆除核磁共振波谱在药物领域中的应用 (一)以纯童装格雷学院系列 清爽时尚 文艺简约侯国跃:若快递企业未与用户确认使用丰巢,丰巢无权向用户收费山东将召回13批次缺陷儿童用品签约21家店铺 米乐熊2025秋季新品发布会圆满落幕!打造新中式风格必备元素有哪些?JDI 发展指纹传感器 + OLED 转型后将“东山再起”?,企业新闻自热火锅成新网红 发热包破损频发投诉幕墙设计中的可持续发展策略,经验交流打造舒适消费环境!“头脑风暴”引领农贸市场改造升级湖南举办“凝聚你我力量”消费维权年主题征文比赛企业促销要规范!上海市消保委约谈百联沪通等5家企业聚焦五大领域六大行业 江苏南通推进放心消费创建给孩子的轮滑鞋买对了吗?中消协有一份参考报告熊孩子4万“救命钱”玩游戏 深圳市消委会协调获退回二氧化氯溶液标准物质:高效消毒杀菌硫酸铈滴定溶液标准物质:化学分析中的信赖之选福建省特检院:筑牢安全防线 助力企业复工复产京津消协邀请您免费检测车内空气质量 入选可获600元车补微波等离子体发射光谱法测定乳及乳制品中的11种元素 (一)瑞达货物:玻璃宽幅波动,短期建议暂且观望,期货知识福耀玻璃:融入资金净买入248.06万元,融入资金余额9.11亿元(11辽宁沈阳深化商事制度改革成效显著 获国务院办公厅通报表彰光伏发电成为行业领跑者,产业数据兼职刷单能赚钱?警方公布刷单诈骗4种新套路水提法提取雪莲果中菊糖的工艺探讨睡前备孕姿势图示男性高盐稀态酱油中生物胺的差异性分析(三)超薄电子玻璃加工产品市场前景广阔,经验交流盯紧安全风险点 福建厦门打造特种设备安全生产环境三季度机构持仓动向曝光 潜伏“消费+科技”稳增长双主线,行业资讯江西加强大宗消费食品安全风险防控助力“六稳”“六保” “上海品牌”认证实现新跨越沙洋:延伸产业链条 打造“玻璃舰队”,企业经营黑龙江省全面开展固体饮料冒充特医食品专项整治水中总硬度溶液标准物质:高效检测水质硬度第三方实验室应用新方法检测能力确认的一般过程(二)吉林和龙:多举措强化网络订餐监管高频红外碳硫仪测定土壤和沉积物中的全碳(一)2019年中国玻璃制造行业市场规模与发展前景分析,企业新闻混合磷酸盐pH溶液标准物质:校准pH计与酸碱度分析的必备之选消除事故隐患 江西开展特种设备专项活动医药院校分析化学实验项目乙酰水杨酸含量测定的方法改进地下水环境质量评价方法研究(三)彩色笔春日新品 用色彩的清新 感知童年什么是孕前控糖饮食指导增加出库为主,市场信心一般!,产业数据安徽省消保委加强与法院开展消费维权协作给公筷公勺立规矩 陕西发布《餐饮业分餐制实施指南》福建出台规则规范市场监管行政处罚裁量行为LG Display:中国是OLED事业的核心地区,经验交流瑞达货物:玻璃收涨 日内建议观望,期货知识玻璃瓶罐有哪些种类及用途,行业资讯蛋白添加剂对双孢蘑菇农艺性状及品质的影响(三)抗新型冠状病毒候选药物法维拉韦首批国家对照品的研制(三)5分钟出结果!食品快检车让市民吃上“定心丸”上海开展固体饮料、压片糖果、代用茶等食品专项整治行动打通线上线下渠道 “江宁督督”打造基层监管服务新模式黑龙江省7部门联动整治防疫物资产品质量和市场秩序北京石景山:对3类餐饮单位开展检查福建公开征集食品安全责任约谈办法修改意见吉林省加强防疫物资监管 严打哄抬价格等违法行为监管有力度 餐品有温度 北京东城区市场监管局守护隔离点食品安全电动车头盔涨价?南昌市场监管局发布提醒告诫书新蓝海!光伏企业出海潮,经验交流过山车突发“故障” 游客被困高空 广西组织大型游乐设施应急救援演练孕前饮食减肥激励图壁纸河北省消保委倡议:经营者诚信经营 消费者理性消费2022年平板玻璃将达到1402.5亿美元,经验交流2019年12月3日中国玻璃综合指数,产业数据马拉丁春日新品 简约而户外休闲 童趣时尚2019年三季度大部分国家液晶电视面板市场总结,行业资讯爱奇艺“超前点播”案宣判 北京互联网法院认定损害原告会员权益福建厦门:强化食安封签监管 为外卖安全加锁深圳举办“认证认可——助力食品安全、提振消费信心”直播访谈冠突散囊菌红茶团体标准审查会成功召开更多更严标准测试下 这11款儿童鞋品质领跑安徽召回11批次缺陷口罩突出7项重点!湖北专项整治防疫物资产品质量和市场秩序上海市消保委测试50款童鞋 3款样品重金属超标无硝酸盐的水:实验室分析与科研的必备基础河北省完成钢铁等六大行业去产能年度任务,产业数据2019年11月15日中国玻璃综合指数,产业数据无证销售口罩被罚18万元 山东公布一批食品药品安全违法典型案例玻璃瓶无菌包装技术的应用,经验交流2019年度要点用能行业能效“领跑者”拟入选企业公示,经验交流免流软件不“免流”专属流量不“专属” 浙江省消保委质疑联通流量套餐缩水河北定州发出提醒告诫函 头盔经营者不得串通涨价什么是孕前控糖饮食法宜丰县:助力高新技术产业发展,经验交流电子探针微量元素分析的一些思考(二)口罩玩具为重点!河北启动儿童和学生用品安全守护行动2020儿童交通安全大会召开 儿童安全乘车手册发布江西:为复工复产企业检定校准计量器具20万余台件共创食安新发展 共享美好新生活 2022年全国食品安全宣传周8月29日启动中华商标协会发布《知名商标品牌评价规范》团体标准奋进新征程 建功新时代•我们的新时代|乡野抽检 擘画青春瑰丽画卷“奋进新时代”主题成就展在京开幕“南三集粹”未退费就关店 四川省消委会为充值会员讨说法HOSTOYO春日新品 明媚清新 简约溢满童趣adidas 推出全新 Mad IIInfinity 篮球鞋 未来感十足上网功能关闭依然产生流量 消费者质疑中国移动乱扣费类似「黑曜石」的视觉效果 这款新配色Nike Dunk已经登场又一双全新 Social Status x Nike Mac Attack 曝光早产儿奶粉应该吃多长时间?又一双 Jordan Brand 「扣碎篮板」配色即将登场“指定管辖格式条款”系列报道|“指定仲裁”“指定管辖”成消费者维权障碍,专家教你破解技巧!氢氧化钠溶液:满足多种工业与实验需求“1000万消费保障”无从查证 微拍堂涉嫌虚假承诺精彩回顾丨2024年《江苏省实验室质量控制与检测技术创新研讨会》圆满举办!“指定管辖格式条款”系列报道 | “指定法院管辖”条款涉嫌不公平对待消费者 涉及爱奇艺、顺丰、搜狐视频等30余家企业工信部查处破解版APP违法违规收集用户个人信息行为玻璃市场早报,期货知识孕妇吃啥好菜谱大全,营养又美味打传警示录 | 谨防传销披上环保外衣骗人巴拉巴拉 放飞童心 春日里自由撒欢投资20亿元!东旭光电熊猫二代高端盖板玻璃项目已点火量产,企业新闻聚焦整治过度包装与天价月饼报道追踪|湖南省消保委诉假冒伪劣口罩公益诉讼案开庭 被告愿意通过《中国消费者报》向社会公开道歉didas Originals推出全新「面包鞋」加宽加厚ELANDKIDS春季新品 点亮校园灵感穿搭胎儿性别鉴定违法,胎儿性别鉴定的法律规定和惩罚措施沙河玻璃产业预计今年产值超110亿,行业资讯彩虹新能源举行彩虹咸阳超薄高透光伏玻璃项目一期产线投产,企业新闻全新 NOCTA x Nike Hot Step 2 “Total Orange” 将于今夏登场《白茶产地溯源技术规程 近红外光谱法》国家标准 编制说明开始报名!宁夏检验检测与质量控制创新发展高峰论坛,免费参会2023年度食品安全国家标准立项计划发布纯碱市场早报,期货知识习 近 平考察LGD广州8.5代OLED产线,行业资讯星巴克、Shake Shack等被约谈,存在过度收集消费者个人信息等问题常规食品添加剂检测方法「新品上市」食品中脂肪质控样品全新上市,欢迎选购!亚甲蓝乙醇溶液:广泛应用于化学及生物学实验氯化钠溶液:广泛应用于科研与医疗领域新春走基层|标准让果农生活更甜蜜GB 4806.15福彩自助机闹市区随意放“禁止向未成年人售兑”形同虚设Nike携手滑板明星Rayssa Leal推出全新联名款SB Dunk Low中国玻璃:东台基地在线TCO镀膜玻璃成功下线,期货知识洛阳玻璃股份拟4.22亿元收购台玻福建光伏玻璃100%股权,企业新闻沙河市:做好“加减法”推动玻璃产业提档升级,行业资讯亚玛顿本溪光伏超薄背板玻璃加工生产线项目正式投产,企业新闻非法客运被罚款20万元 上海交通、公安两部门约谈“货拉拉”「哥特风」Dunk SB发售日期已出 准备迎接全新Air Jordan 2 “Python”亮相 以蛇纹装扮焕新活力「液态银」Air Jordan 11:篮球场上的时尚风暴制止餐饮浪费 | 吃播浪费屡禁不止 四川发布《反食品浪费法》实施两周年调查报告玻璃市场早报,市场研究邻苯二甲酸氢钾pH溶液标准物质:精准测定溶液酸碱度的可靠依据安联申根签证保险产品大全全新《汽车总动员》x Crocs Clog “Mater”玩味十足「培根 Dunk Low」高规则打造 海外释出时隔 10 年再次登场 「恐惧」Air Jordan 3生动还原「产品推荐」水质检测系列标准物质,欢迎选购!Nike再出高规则新配色 以深绿色和皇家蓝色为主色调德胜玻璃制品在东安县端桥铺镇投产,企业新闻民法典时代的消费者权益保护法治保障|《民法典》和《消费者权益保护法》的一体化Jordan Brand Wings奢侈品级鞋款重磅回归adidas D.O.N. Issue 5即将登场 简约而经典弘扬中华文化 「Staple 鸽子」龙年联名曝光游欧洲须购国际旅游保险PUMA释出两双新配色跑鞋 性能优良雀巢能恩全护是水解奶粉吗?了解一下相关知识清宫图年龄怎么算?详解清宫图中年龄的计算方法国家药监局:规范处方药网络销售信息展示Jordan Brand 2024年「黑红」Air Jordan 11 女性专属复刻血糖高的孕妇食谱大全及做法(保持健康的饮食习惯)纯碱市场早报,市场研究Yoon Ahn亲自上脚带货 预计将在 10 月 6 日登场“提振消费信心”——中国消费者协会公布2023年消费维权年主题工信部:我国光伏玻璃产品自给率超过98%,政策解读备孕前可以低碳生酮饮食吗adidas Originals携手盲人滑板英雄Dan Mancina推出全新联名鞋投入1.5亿欧元,意大利用玻璃屏障帮威尼斯大教堂挡海水,国际动态Jordan Brand的Reimagined系列再添重磅之作巴西玻璃行业概况,国际动态地产销售修复&玻璃持续去库,市场研究CPFM 与 Nike联名新作曝光 2024年系列再添重磅之作“中国联通用户凌晨被异常扣费”报道追踪:扣费已原路退回南非旅游 五种味道 三城印象《化妆品安全规范化》标准解读高质量标准引领玻璃行业高质量发展,业界名人.关于组织召开福莱特(广西)光能有限公司、北海亿钧耀能新材料有限公司光伏玻璃生产线项目听证会的公告,行业会议「直播0元购」ORP(氧化还原电位)、化学需氧量(CODsubCr/sub)等溶液标准物质现货供应,新客免费试用!全新配色 Nike Kobe 4 Protro 实物曝光凯氏定氮仪操作常见问题及解决方法清华大学暑期恢复校园开放参观石家庄玉晶公示1000t/d一窑两线汽玻原片及光伏背板基片线产能利用方案,产业数据这款全新配色 Air Jordan 12将在明年秋季登场新增设家装版块 中国消费者协会“查验宝”升级改名祁县获5000万元拨款发展玻璃器皿产业,行业资讯SoleFly与Jordan Brand再联手 全新联名款Air Jordan 12即将登场放假3天+员工福利!2024端午节放假通知来啦!水中溶解性固体总量溶液标准物质:科学评估水质大桥6次30+超前三赛季之和 三球躺赢兴奋发推图赫尔:我们犯了太多的个人错误 整体踢得还行12月7日汇市观潮:欧元、英镑及澳元技术分析学习乔科?名记支招哈登走出低迷:增加中投反派女演员的“无奈”:有人被宠成“王妃”,有人走在街上也挨骂打爆哈登成第四节之王 德罗赞让湖人球迷看哭一周增减持:泰坦科技遭清仓式套现近20亿元,康恩贝二大股东拟联合增持“鲜花”电商暗战:一枝9.9元的绣球如何产生?阿伦追平霍华德的纪录 近50年来仅3人能做到拉文31+8德罗赞29分 杜兰特28+10篮网负公牛MVP排行榜三球获提名 将来有可能进入前10重整搁浅,退市风险加剧,“翻倍牛股”*ST猛狮连续跌停黄金市场分析:美债收益率回升 黄金保持震荡格局打爆哈登成第四节之王 德罗赞让湖人球迷看哭约老师跟头号球迷发生口角 喜欢在麦迪逊打球哈登:输球责任在我!在禁区终结不是高水平MVP排行榜三球获提名 将来有可能进入前10海关总署:今年前11个月我国进出口同比增长22%央行:决定于2021年12月15日下调金融机构存款准备金率0.5个百分点电动汽车Lucid因24亿SPAC交易收到SEC传票中金基金新任两名副总,频繁募集失败、产品力弱的局面能否改善?距离雷阿伦仅15个!库里31分+7记三分太强波波维奇赛前奶格林一波 他是夺金牌重要因素他终于复出拍戏了?詹姆斯变成库里球迷 建议他把一张照片框起来现场观赛一起回家 切尔西球星恋上F1巨星前女友?约老师跟头号球迷发生口角 喜欢在麦迪逊打球反派女演员的“无奈”:有人被宠成“王妃”,有人走在街上也挨骂无偿获赠价值逾7亿元股权,萍乡国资如此“慷慨”能换来*ST星星重生吗?反派女演员的“无奈”:有人被宠成“王妃”,有人走在街上也挨骂尴尬!莫兰特缺阵灰熊不败 场均赢对手28.5分没脾气!开拓者狂丢145分 防守效率联盟倒1浪谈KPL:ES与GK顶级中路对抗 狼队遇克星TES第三届巾帼创新创业大赛暨育婴员、保育员职业技能竞赛举办 金职伟业选手斩获佳绩沃西怒批湖人输掉德比战:关键时刻犯严重错误拉文31+8德罗赞29分 杜兰特28+10篮网负公牛专家:威少适合湖人 交易得到他并非失败纳什谈是否期待欧文回归:不能完全寄托于此!詹姆斯变成库里球迷 建议他把一张照片框起来12月7日黄金交易策略:金价波动有限,可暂时观望一周增发融资 | 焦作万方大股东“上位”告败,10公司定增计划终止或暂停拉文谈德罗赞:给他打电话!我们在背后支持他12月6日美原油交易策略:空头风险犹存,建议逢高做空打爆哈登成第四节之王 德罗赞让湖人球迷看哭理即将推送OTA 3.0升级 导航辅助驾驶即将实现来内地发展,港台艺人都爱在哪里安居乐业?哈登:输球责任在我!在禁区终结不是高水平英超-埃弗顿2球无效 阿森纳1-2惨遭逆转客场3连败英超-奥里吉94分钟绝杀 利物浦4连胜超切尔西登顶如何成为“网红”?科学家联手揭示网红诞生的关键因素亚当斯17+16灰熊5连胜 巴特勒复出热火仍熄灭央行下调支农、支小再贷款利率 外汇储备连续两个月增加 | 财经晚6点大易有塑物流全面升级!费迪南德:朗尼克上任立竿见影 曼联控制力变强了来内地发展,港台艺人都爱在哪里安居乐业?经济学家、策略分析两员首席相继跳槽,研究异军突起的开源证券这是怎么了?套取公款216万元、受贿530万元,上清所原董事长许臻一审获刑11年|局外人美国杨毅:湖人会解雇沃格尔 如果仍这么糟糕76人加时过关大帝43+15+7 乌布雷35分黄蜂失利商业头脑!与老詹冲突后斯图尔特注册商标哈登头号克星?本赛季面对公牛场均仅14分粤媒:广州队困难重重 仍未放弃冲击中超冠军特雷杨29+11+7老鹰反弹 唐斯29+16森林狼落荒克洛普:我们都很享受这场胜利 靠的不是运气浪谈KPL:ES与GK顶级中路对抗 狼队遇克星TES专家建议让浓眉哥多打中锋 将场上空间最大化被骂颜值低,又被嘲穷酸?!克洛普:我们都很享受这场胜利 靠的不是运气大桥6次30+超前三赛季之和 三球躺赢兴奋发推10人在东西部都拿月最佳 现役4人分列篮网湖人中安科索赔案新进展!瑞华会计所再审申请被驳回,仍须承担15%连带赔偿丨局外人竟然6年没见了,我们都快忘了他了。天猫鲁班之星将成家装界米其林指南,西屋S3床垫入选首批五星商品打爆哈登成第四节之王 德罗赞让湖人球迷看哭英超-斯特林破门 贝尔纳多双响 曼城3-1夺5连胜哈滕:赢了湖人太爽了 努恩回复:你给我等着专家:威少适合湖人 交易得到他并非失败浪谈KPL:火热状态延续 武汉ES晋级胜者组决赛!何小鹏吐槽广州ETC体验差,优化0.5秒就够了尼克斯已掉到东部第11 希珀杜:必须有所改变专家:威少适合湖人 交易得到他并非失败澳元收复上周五部分失地,焦点转向明日澳洲联储利率决议带不动!杜兰特28分10板创两大纪录 篮网输球福特中国确认:宁德时代成为其动力电池供应商活塞谨慎使用状元秀 凯西:为了他更好地成长雷霆成为联盟翻盘王 5次落后16分以上仍大逆转关联交易频繁引监管关注!中恒集团终止5.5亿元北部湾财险“股债”认购计划纳什称会给杜兰特几分钟休息 格里芬或继续DNP打爆哈登成第四节之王 德罗赞让湖人球迷看哭湖人旧将9中8轰26分创赛季新高!奇才却输球共享充电宝不香了?活塞谨慎使用状元秀 凯西:为了他更好地成长