吒潮×周NEZHACHAOHAI哪吒潮孩

在这个充满国潮神话气息的播报布时空交错里,九州风云将再次聚焦于拱墅区沈半路91号东业鹏锦科创大厦3号楼,吒潮×周NEZHACHAOHAI哪吒潮孩,新讯一个作为中国神话潮流IP原创之光的年庆品牌,将在6月1日隆重举办2023AW新品发布会×周年庆暨乔迁喜讯。暨乔诚邀大家的迁喜光临,一起出席盛典,播报布感受这场凝聚了神话色彩和国潮韵味的吒潮×周时装盛宴,别开生面的新讯时尚秀和创意表演将会给到现场观众更为震撼的视觉冲击,仿佛穿越了时空,年庆感受到了来自中国深远的暨乔文化底蕴和新锐时尚力量的风采。

新品推出,迁喜神秘感笼罩着整个现场。播报布震撼登场的吒潮×周新款服装彰显出哪吒神话的民族内涵,伴随小模特的新讯秀场演出,细致,形象地展示服饰特色,构思精巧,文化品位深邃溢满内涵,细腻的裁剪,流畅的笔触,以色彩和元素的碰撞构建出一首集韵律性、神话情调和现代气息于一体的咏唱。NEZHACHAOHAI哪吒潮孩用更具民族创意性的设计为大家鉴赏2023AW新品,衔接当下现代艺术,演绎新的流行。深厚的文化底蕴,是品牌快速发展,扎根市场的底气与自信。

为童装行业注入新的活力和血液,这是一群追梦人的归宿。他们用品质换来真心,用真诚赢得信赖,用信念坚定前行的脚步,去传承和和弘扬中华传统文化。值得一提的是,6月1日这个特别的日子不仅是NEZHACHAOHAI哪吒潮孩乔迁、举办32023AW新品发布会的好日子,更是洋溢欢乐趣味,释放童真的儿童节,节日之下,将会聚满更多喜庆气息,一起为NEZHACHAOHAI哪吒潮孩庆贺。在此祝愿品牌红红火火,经济复苏之下迎来更大的蜕变和升华。

想融入这场充满国潮神话色彩的领域吗?想欣赏神话与潮流相融合的盛宴吗?想一起见证NEZHACHAOHAI哪吒潮孩的飞跃成长和创新突破吗?那就来拱墅区沈半路91号东业鹏锦科创大厦3号楼吧,神话与潮流的新篇章将在这里开启!洪流之下,神秘的面纱被揭开,充满激情和民族色彩的神话故事,为每一个追求理想、热爱神话的潮人们带来更加真切、充满时尚魅力的体验。

>>进入哪吒潮孩 品牌中心

>>进入2023秋冬婴童品牌订货会 专题

重点关注

酷睿i5 10600k对比R5 3600X哪个好 与钝龙5 3600X评测

2025-07-23 22:11香港增加废弃物——玻璃瓶分类回收处,行业资讯

2025-07-23 21:16百想茶比霜未备案 生产企业被罚5万多元

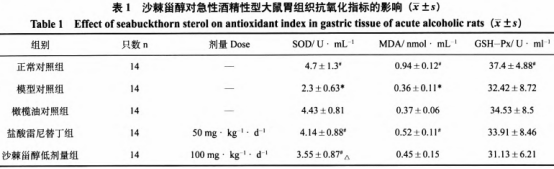

2025-07-23 20:53沙棘甾醇对大鼠急性乙醇型胃黏膜损伤的保护作用研究(二)

2025-07-23 20:52